Jul 2

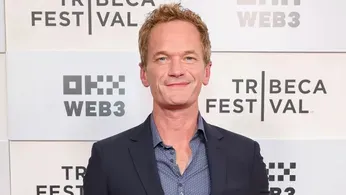

'What's in the Box?' Neil Patrick Harris, for Starters

Kilian Melloy READ TIME: 2 MIN.

Out actor Neil Patrick Harris is set to take on a whole new role of a game show host for the upcoming Netflix show "What's in the Box?" Big prizes are reportedly the name of this game.

Variety reported that, according to Netflix, the show will be a "'massive guessing game' where each decision could lead to 'life-changing rewards.'"

"In 'What's in the Box,' which launches in December, giant boxes conceal astonishing prizes, wild surprises, and unexpected reveals," Netflix teases. "Over six episodes, host Neil Patrick Harris will lead pairs of contestants through rounds of fast-paced trivia as they race to guess what's inside each box."

"But unpacking the prize is only the beginning," the streamer's writeup adds. "As the high-stakes game unfolds, competitors' smarts, strategy, and stamina will be tested. Shifting alliances and unexpected twists mean only those with sharp instincts – and a little luck – will hold onto their winnings and claim victory."

This won't be Harris' first gig as a host – or even his debut as a game-show host. Variety recalled that the "How I Met Your Mother" star "previously anchored the NBC game show 'Genius Junior' and has MCed a bunch of award shows, including the Tonys, Emmys and Oscars."

He might be better known for his scripted TV work, which includes the queer Netflix sitcom "Uncoupled" – a one-season series co-created by "Sex and City" creator Darren Star. Harris led the show as a gay man who finds himself dumped, dazed, and dating in his middle years. Reviews were mixed; Netflix dropped "Uncoupled" after its inaugural season, and though Showtime flirted with picking it up for a second round, the show's prospects for a return eventually evaporated.

The six-episode first series of "What's in the Box" will reportedly feature 45-minute episodes, which is unusually long for a game show. The show is expected to bow in December.